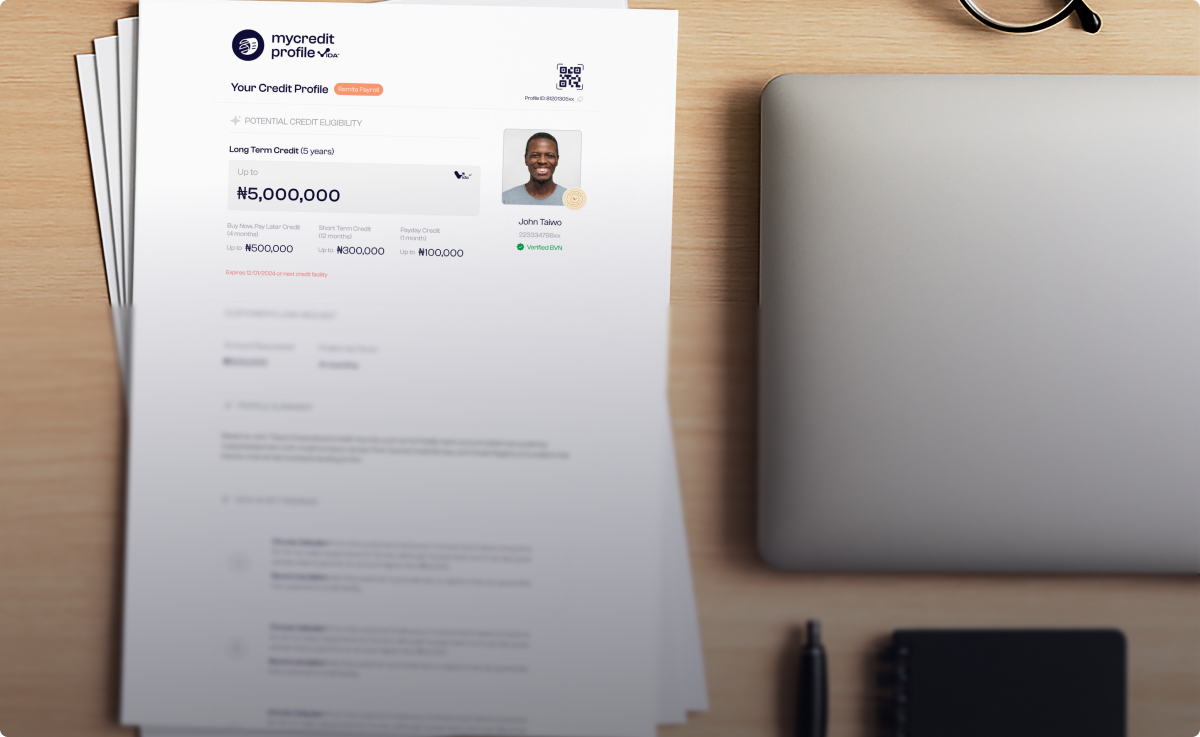

Get your credit profile in minutes

Unlock insights into your financial strength and take control of your future with a detailed credit report that empowers you to make confident life decisions.

We are backed by

TESTIMONIALS

Listen to stories from our customers

Veend's credit profile helped me secure an instant loan to pay my daughter's school fees on time. The process was seamless and flexible.

Adeola A.

BENEFITS

What can you do with mycreditprofile?

Your credit profile is your financial passport to better opportunities. Whether you're applying for loans, seeking employment, or expanding your business, MyCreditProfile provides the comprehensive financial verification you need to succeed.

Loan Applications Made Simple

Stand out from other applicants with professional-grade financial documentation that builds lender confidence and increases approval chance.

Qualify for Better BNPL Services

Access premium BNPL services with confidence, knowing your financial health is professionally documented and verified.

Excel in Pre-Employment Background Checks

Present a complete, professional financial profile that demonstrates responsibility, integrity and trustworthiness to potential employers.

Streamline Visa Applications

Provide comprehensive financial documentation that meets international standards and accelerates visa approval processes.

Strengthen Grant Applications

Demonstrate financial responsibility with detailed reports that increase your grant approval chances significantly.

Simplify KYC Processes

Complete KYC processes faster with comprehensive financial profiles that meet regulatory requirements immediately.

Secure Asset Financing Easier

Present lenders with comprehensive financial profiles that showcase your true creditworthiness and ability to service asset-backed loans.

Access Agricultural Loans Faster

Get agricultural loans approved faster with financial profiles designed specifically for the agricultural sector's unique financial patterns.

Join Cooperative Societies with Confidence

Gain cooperative membership and access to group lending facilities with comprehensive financial documentation that proves your integrity and creditworthiness.

OTHER BENEFITS

Why you need mycreditprofile

Comprehensive Financial Analysis

MyCreditProfile offers you a deeper view than basic credit scores, using AI to assess your full financial health for a complete picture.

Industry-Specific Reports

MyCreditProfile reports are tailored to your specific needs whether for loans, visas, or more.

Instant Generation

Get your complete, professional credit report in minutes processed and generated instantly using your financial data.

Bank-Level Security

Your data is safeguarded with enterprise-grade encryption and advanced security protocols.

HOW IT WORKS

Take Control of Your Future Today

Don't let incomplete documentation hold you back from the opportunities you deserve. Join thousands of Nigerians who have transformed their way of living with MyCreditProfile.

Own a credit profile in 3 simple steps

Connect Your Accounts

Securely link your bank accounts and financial data.

Generate Your Profile

Our system infused with AI creates a comprehensive credit report for you instantly

Access New Opportunities

Use your credit profile for loans, job applications, grants, visas, and more.

FAQs

Questions we hear most of the time

What is a credit profile?

A credit profile is a personalised document that shows your credit-worthiness, credibility and eligibility assessed based on your financial information and data we pulled from multiple data sources.

How can I create my credit profile?

You can create your credit profile by connecting your accounts, and completing all needed requirements requested.

Do I need to pay to create a credit profile?

Yes, your credit profile is your financial passport to opportunities, and it only costs ₦5,500.

Is there an assurance I will get a loan after paying for my credit profile?

Getting a loan depends on your profile, the lender, and their terms. But with our report, you're presenting your strongest possible case.

Why is my eligibility low?

There are diverse reasons why your eligibility could be low, one of them could be that you have existing loan obligations with other lenders. Your credit profile provides you with more insights as regarding why your eligibility is low.

How can I increase my credit eligibility?

Mycreditprofile provides you with AI-powered insights into how you can improve your credit eligibility based on your credit profile.

Ready to seize your opportunities?

Join satisfied users who have maximised their opportunities with MyCreditProfile. Don’t wait, empower your tomorrow, today.